Understanding NFL Rules

Game Structure

A standard NFL game consists of four quarters, each lasting 15 minutes. If the score is tied at the end of regulation time, the game proceeds to an overtime period. The clock stops for incomplete passes, out-of-bounds plays, timeouts, and after certain penalties. Each team has three timeouts per half to strategize and reorganize.

Scoring

The NFL employs various ways to score, including:

- Touchdown (6 points): Achieved when a player crosses the opponent’s goal line with the ball.

- Extra Point (1 or 2 points): After a touchdown, teams can opt for a one-point kick or a two-point conversion from the two-yard line.

- Field Goal (3 points): Scoring by kicking the ball through the opponent’s goalposts.

- Safety (2 points): Awarded to the defense when the offense is tackled in their end zone.

The Down System

The game is structured around a system of downs. The offense has four attempts, referred to as “downs,” to advance the ball at least 10 yards. If successful, they receive a new set of four downs; failing to do so results in a turnover on downs to the opposing team.

Penalties

NFL rules outline numerous infractions that can result in penalties, typically resulting in a loss of yardage or the loss of a down. Common penalties include:

- Offside: A defensive player crosses the line of scrimmage before the snap (5-yard penalty).

- Holding: Any player illegally grabbing an opponent’s jersey or jersey-like material (10-yard penalty).

- Pass Interference: Interfering with a receiver attempting to catch a pass (varied penalty, can be a spot foul).

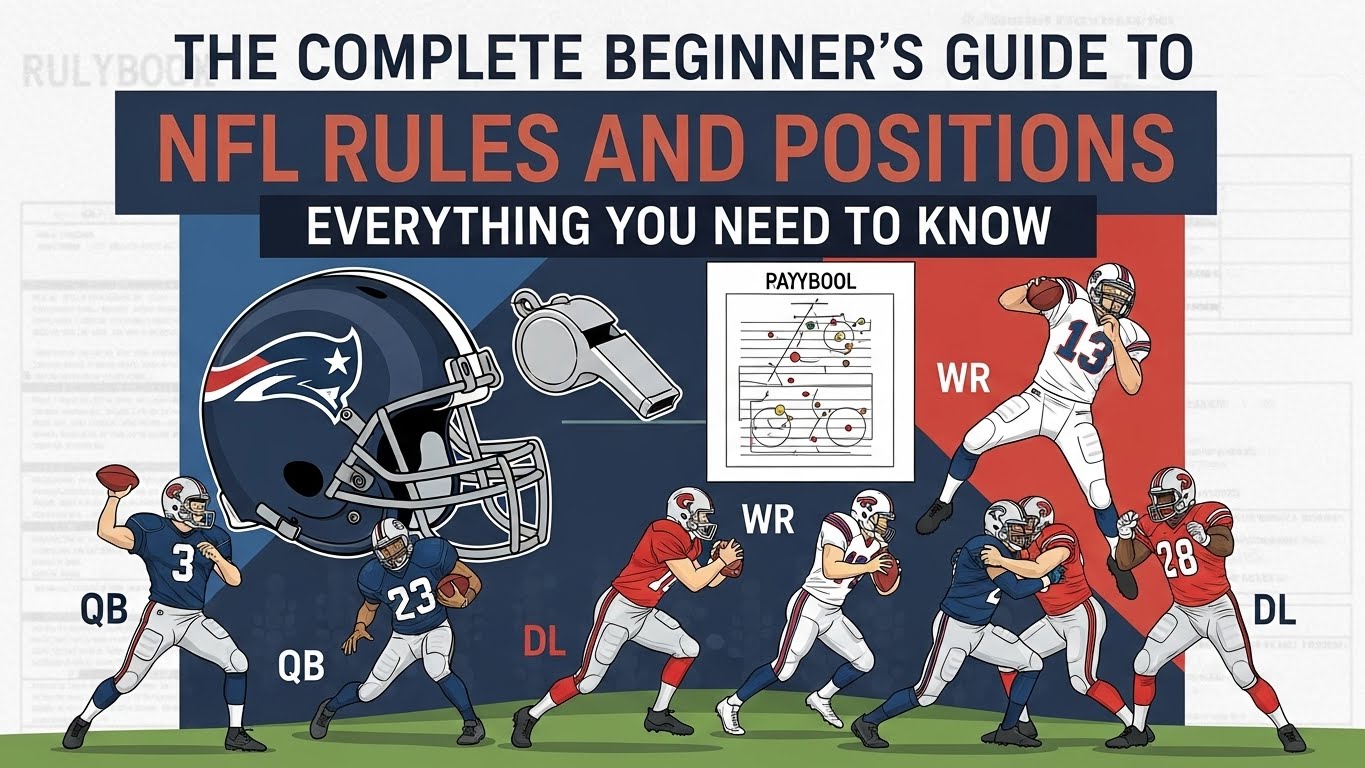

Key NFL Positions

Offense

-

Quarterback (QB)

- The leader of the offense, responsible for calling plays, throwing passes, and managing the game. Notable QBs include Tom Brady and Patrick Mahomes.

-

Running Back (RB)

- Primarily tasked with rushing the football. They can specialize as:

- Halfback: Main ball-carrier.

- Fullback: Often serves as a blocker and occasionally carries the ball.

- Primarily tasked with rushing the football. They can specialize as:

-

Wide Receiver (WR)

- Focused on catching passes. They utilize speed and agility to create separation from defenders. Receivers can be classified as:

- Slot Receivers: Operate primarily in the middle of the field.

- Outside Receivers: Line up on the edges of the field.

- Focused on catching passes. They utilize speed and agility to create separation from defenders. Receivers can be classified as:

-

Tight End (TE)

- A hybrid position combining aspects of blocking and receiving. They serve as both supports in running plays and targets in the passing game.

- Offensive Linemen

- Protect the quarterback and create paths for runners. This group comprises:

- Tackles: Guard the ends of the offensive line.

- Guards: Play inside the tackles, offering additional protection.

- Center: Snaps the ball to the quarterback and is responsible for line calls.

- Protect the quarterback and create paths for runners. This group comprises:

Defense

-

Defensive Linemen

- Responsible for stopping the run and pressuring the quarterback. This typically includes:

- Defensive Ends: Positioned on the outer part of the line to contain runs and rush the quarterback.

- Defensive Tackles: Line up inside the defensive line and tackle runners.

- Responsible for stopping the run and pressuring the quarterback. This typically includes:

-

Linebackers (LB)

- Positioned behind the defensive line; they are versatile players who can defend against both run and pass. They include:

- Middle Linebacker (MLB): Generally the leader of the defense.

- Outside Linebacker (OLB): More focused on pass coverage and rushing the quarterback.

- Positioned behind the defensive line; they are versatile players who can defend against both run and pass. They include:

- Defensive Backs (DB)

- Tasked with defending against the pass and preventing receivers from making catches. They include:

- Cornerbacks (CB): Cover receivers on pass plays.

- Safeties: Provide deeper coverage and are involved in run defense.

- Tasked with defending against the pass and preventing receivers from making catches. They include:

Special Teams

Special teams handle all kicking plays, separate from offense and defense. This includes:

- Kicker: Responsible for field goals and extra points.

- Punter: Kicks the ball during fourth downs if the offense is unable to advance.

- Kickoff and Return Teams: Manage the field position, either kicking the ball to the opposing team or returning a kick.

Game Strategy

Football strategy involves various formations and play-calling. Coaches employ different strategies such as:

- Offensive Formations: 5 wide, I-formation, Shotgun, etc. Each formation determines player alignment and play approach.

- Defensive Schemes: 4-3, 3-4, Nickel, etc. Each dictates player positioning based on the offensive setup.

Understanding Other Game Elements

The Play Clock

Each team has 25 seconds to start their next play after the previous one concludes. This rule ensures the game maintains pace.

Instant Replay

The NFL employs technology to review certain plays, upholding accuracy in game decisions. Coaches can challenge specific calls, but limited timeouts can impede their ability to do so.

Challenges

A team is allowed two challenges per game but can only remain if one of their challenges is successful.

Understanding these rules, positions, and strategic components offers insight into the complexity and excitement of NFL football, enriching the viewing experience for both new and seasoned fans.